Real Strategies - The CPI Trade

A low latency trade with multiple profit angles

Introduction

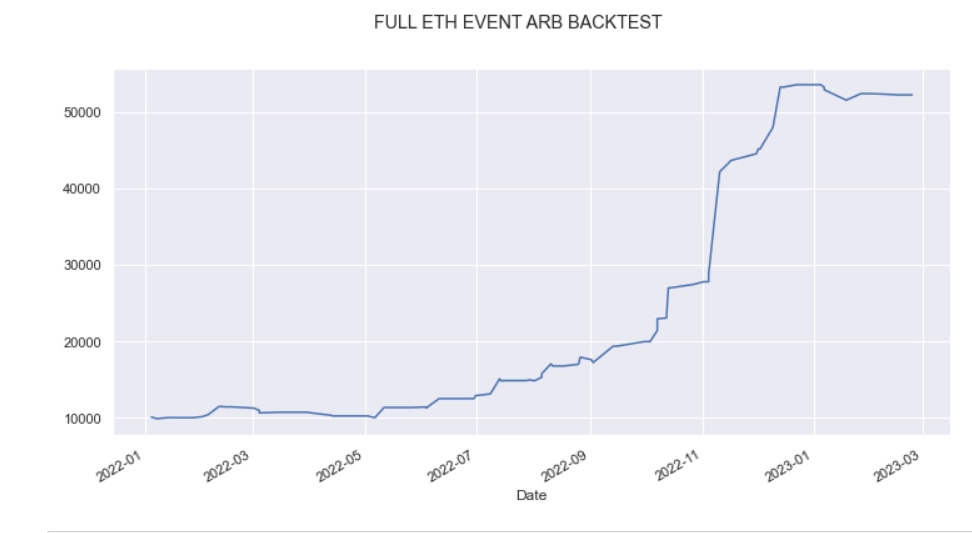

Pricing in events typical falls under the realm of event arbitrage, and we’ve talked about this before extensively, but let’s look at a real example that made real PnL. I know a couple other fund manager friends of mine ran this same trade so it certainly was no secret, but it also wasn’t well-known enough to be arbitraged away. There’s also multiple angles on the effect that produce profits.

This is a trade that existed for a long time and still exists today, but to a lesser degree due to the enthusiasm, mostly from retail traders, that surrounds CPI releases.

This will be a short article. It’s not a crazy complicated alpha - I’ll explain it in as much detail as needed and leave the rest to the reader.