Small Trader Alpha #4 - Funding Arbitrage

Exploiting niche funding arbitrage opportunities for financial gain

Introduction

In the heyday of funding arbitrage strategies, back in 2020 & 2021, it was quite normal to see people making 100% returns on 8 figure sums, but as we entered the bear market and as people caught onto the strategy, it began to fade. Now, as the bull market re-emerges, and with many of the traditional market participants removed, we are seeing a renaissance in the funding arbitrage strategy. Better yet, with the explosion of decentralized perpetual exchanges, there is now far more of an opportunity for the niche trader - without needing to engage in the headache of KYC’ing with tons of exchanges.

Small exchanges are great for niche arbitrages, especially when they have factors that keep away large players, such as liquidity faults and cybersecurity/compliance risks.

There are two main versions:

Spot / Perpetual

Perpetual / Perpetual

Funding arbitrage involves collecting funding payments in exchange for holding positions that bet on the convergence of two mechanically tied assets. While we need to consider how the convergence or continued divergence of the two assets may affect our trade, betting on this basis is not the core part of the trade; instead, we focus on the differential of payments.

For spot against perpetual arbitrages, we need to acquire cheap borrowing of spot on the short side and own spot on the long side (we will see how regimes then affect this later). For perpetual to perpetual, we usually are taking a perpetual on the same instrument, either slightly different types (coin margined vs USD margined) or across exchanges (most common).

A code demonstration on how to build this into a system is provided at the end, with some technical guidance on implementation.

Index

Introduction

Index

Regime Variability

Managing Shock Risk & Margin

Sources For Borrow

Expected Holding Times

Entry & Exit Timing

Risk Premiums

Reducing Impact & It’s Importance

When Is Cross-Exchange Funding Priced-In?

Differences In Funding Intervals

Implementation Guidance [CODE INCLUDED]

Regime Variability

One characteristic of the funding arb strategy is its dependence on the directional state of the market. When there is a bull market, futures tend to be the asset above spot most of the time:

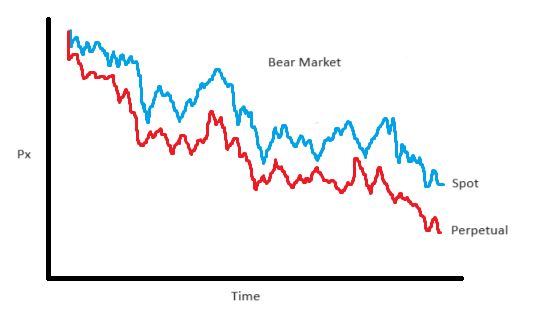

However, we see the opposite in a bear market, where the perpetual tends to be below spot prices. One effect not shown, is that when there is a bear market we tend to see a lack of opportunities in general as people become more desperate for opportunities.

But why do we care which is above which?

In the bull scenario, we buy the spot and short the perpetual. We earn funding on the perpetual and pay no cost to hold the spot - we may lever into the spot position, but this is relatively cheap because we are borrowing stablecoins.

In the bear scenario, we need to short spot - this introduces short borrowing costs. While we may get paid on the long perpetual leg, it is typically very expensive to short spot, and it is tricky to find the borrowing availability. This culminates to mean that funding arbitrage is much harder to make money on in bear markets.

Managing Shock Risk & Margin

Funding arbitrage is a leveraged strategy for almost everyone who runs it. This means that we need to manage risks and control our margin. It is easier when the position is on one exchange, say if we were doing spot to futures on Binance, in which case we simply need to rebalance the position to take profits on one leg and cover losses on the other. We may even be able to leave the losses/profits because the exchange counts our profits between the two (depends on the exchange).

The more likely case, though, is that we will have complex cross-exchange positions. We can have our spot borrow sources from a DEX, but then our perpetual position is traded on a CEX, or even have two perpetual positions between CEXs that we are arbitraging.

There are real cases I know where friends of mine blew up because they overleveraged into basis spreads between two exchanges. Then, a large 100% move happened on one asset, resulting in huge gains on one exchange, but also huge losses on the other exchange. They couldn’t move capital in time to cover the margin difference, and this resulted in a liquidation. This is VERY expensive. Not only because you have exited the trade at the worst possible time, when the basis has gone against you, but that you now have a naked leg to close on another exchange, plus are paying huge liquidation fees (often 1%+ * your leverage, so potentially double digits).

To model this sort of risk, you should use shock analysis. What would happen if this one asset shocked up XX % suddenly? What is the probability of that happening? If it’s a shitcoin, then look at other shitcoins, not just it’s price history. Understand that if BTC has a large move, then all the other tokens will follow, likely in a much more pronounced magnitude. Make sure that your portfolio can survive these shocks without getting liquidated.

It is also important to have automated systems to remove the second leg then if you get liquidated on one exchange and to automate transfers of margin between exchanges to reduce the waiting time (this can pose a cybersecurity risk to have APIs moving capital; some firms will avoid this practice as a result).