Introduction

I’ve got quite a few organized papers on the topic, so I figured I’d share them today, and then do a bit of a literature review in terms of where I see the space.

It’s important to abstract away what pairs trading really is, and that’s just a way to find relationships between assets to price them. The prior article on lead-lag relationships is a distilled example of this but with a bit less hedging. In this case, we are saying that one will do all, or most of, the moving as opposed to convergence between the two equally. Convergence is what we focus on today, but of course, we can draw parallels to lead-lag and other areas because they are really all quite close.

If you enjoy this, feel free to subscribe. The subscriber number going up makes me write more content and you get the content I write delivered straight to you.

Here is a brief overview of our sections:

Copulas

Optimization Based

Multi-Objective Optimization

SDP

SMRP

Misc

Bivariate

Multivariate

Lead-Lag (DTW, we focused on graph-based approaches in the last article so these papers are all Dynamic Time Warping)

OU / Stochastic Control

Regime Shift

Metrics

Cointegration

Math Reading

HFT Pairs

Clustering & Pre-Selection

Misc

Notes from me

Please remember that this is simply a write-up of maybe 100 or so papers from my paper archive. There are thousands of papers in this folder that I’ve pulled from so I shall try my best here, but papers may be misplaced.

Copulas

Copulas are simply a model for expressing a relationship between two assets. There are roughly 3 areas where copulas exist in the literature:

Low Dimension

High Dimension

Vine Copulas

The lower dimension copulas are the ones you’ll read about in most popular papers. It’s generally seen as a dead approach, but there is often alpha in doing simple things well so I wouldn’t say it’s worth skipping entirely. Simpler markets where you optimize txn costs certainly could see this prevail, but there are also more advanced methods in the literature now.

Higher dimensional copulas are great for performance and certainly represent an improvement by allowing us to incorporate more assets. Sadly, the assumptions are often a bit too rigid as we go up in dimension.

Vine copulas are the solution we need for higher dimensions and are the most cutting-edge niche in the field of copulas.

There’s also some interesting work I did on using Kernel copulas, but I never finished that paper and it kind of became a rabbit hole so we won’t go into that. Math is hard kids. Do check out the topic though in your own time - it was fun.

Optimization Based

As many of you will already know, I’ve written a LOT about this part of pairs trading on the research blog and I’ll link to past articles as well as papers here so I don’t end up repeating myself. There’s a ton of cool tricks and it’s great to be able to walk through the strategies with code and real examples, not just anecdotes from years of fucking around and finding out.

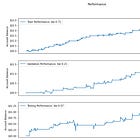

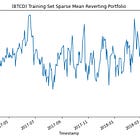

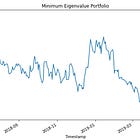

We have multi-objective-based optimization which is what the name says. We have SDP (Semi Definite Programming) which is a convex optimization method I’ve written a bit about / have shared code for in prior articles. There are SMRPs (Sparse Mean Reverting Portfolios) which I have spent a lot of time poking around in and even published a working strategy on it. We also have a nice misc section. Most of these I could explain again but you could also just read prior articles for a much better job instead of me skimming through it.

Starting with prior articles:

For the papers:

Multi-Objective:

SDP:

SMRP (HMM):

SMRP Cont.

Misc:

Bear with me and maybe skip the neural networks. NNs were fun topics, but they never yielded much results (KISS - Keep it simple stupid).

Bivariate

2 assets, 1 portfolio. Simple as that. Here goes:

Multivariate:

This has some interesting relations to the optimization section as well, but I did keep them separate since they generally appear to be two distinct literatures. A lot of the papers in this area tend to reference each other whilst the optimization section tends to reference others in that section. That said, they’re similar:

Lead-Lag (DTW)

The above article gives quite a few papers on the subject, especially in the graph-based approaches but here are quite a few papers from my dive into DTW:

OU / Stochastic Control

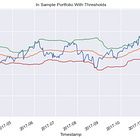

Some people seem to really enjoy this area, maybe it is the math, but I always found that it was too conservative and the assumptions were too rigid to work well in practice. Bollinger bands for the win imo. That said, you can find some very well-behaved spreads, closer to the pure arb part of the trade that this applies well to so I think it’s worth learning:

Regime Shifts

Honestly, you can find simple proxy metrics that do the job just as well, but there is a bit of a literature. I’ve spent my time reading and testing these to know they don’t work that well so now hopefully you won’t need to either. This is a paper dump though so here they are:

Metrics

I like this part a lot. It’s a fun area and thinking about what these metrics are truly describing is an integral part of the process when it comes to building good relationships between assets:

Cointegration

This is the one everyone knows. There are some interesting approaches to it that have come out recently but I think they’re still too close to what is a dead trade. We can do well finding underdeveloped markets / fundamentally robust pairs and using these methods, but there’s a lot more thought that goes into it:

Math Reading

You should probably get good at math if you want to be a quant, especially if you are interested in a model-focused area like pairs trading. Here’s some material to help you along:

HFT Pairs

There’s a bit of literature on pairs trading for high-frequencies, but with all things HFT, you need to learn from practice. The literature tends to be less relevant for HFT strategies owing to the very practical and market feedback-oriented development process behind them which academics/theory-loving individuals tend not to go for. Either way here are a few, but I do recommend reading some of my material on this which is a bit more practically focused (although it is still quite mid-frequency in its scope), and of course testing for yourself:

Clustering and Pre-Selection

I never dove too much into this from a theory/models perspective because my approaches were usually based on fundamental similarities behind assets such as industries, but there is a machine learning side of things that is quite interesting and that I have explored a little:

Misc.

I don’t have more papers to share, but I do want to give a shout-out to financialnoob who has written a decent bit on pairs trading and shared a lot of code. I think it’s a great resource for those diving into the subject and covers most of the simpler methods that I perhaps have glazed over.

Simple methods do well and often are the most robust way to do pairs trading. Don’t write them off. I worked on pairs trading at a more model-focused time in my life and hence my thoughts and writings often flow into this area, but my current research represents more of a balance.

It isn’t very pairs trading oriented anymore, but I’ve had a few looks around in the years since pairs trading and have enjoyed the application of simpler models to dumber markets.

Both sides of the coin are fun and teach you a lot.

https://medium.com/@financialnoob

He’s also got a Github which saves me from writing code on these methods (mostly ones I haven’t covered yet anyway) and as a bonus it’s all free. Enjoy :)

Notes from me

Please excuse any mislabelling of papers, I’ve put a lot of work in but as you can see there are a lot of them to go through, and as with all papers - I skim. Hopefully, my commentary has provided guidance and my articles that exist so far will provide more practical insights into this area of strategies.

On the point of skimming, do it. Have a skim and then come back to what you enjoy. There’s a lot to get through and most papers don’t require you to read the full thing to get the general idea. If you really like the idea then of course dive in and code it up / test it out - it’s a great way to learn, but do be diligent with your time. It’s not a great idea to just sit there and read them all day, in full - you’ll forget a lot of the parts anyway if you do that.